Who does not want to improve their profitability? Even Not for Profit organisations need to get value for money and ensure their funds go as far as possible.

Most commercial enterprises will concentrate on revenue generation and that is obviously justified. However, I am not here to share the latest tips on lead generation or closing a sale, instead I would like to challenge you on whether you have examined each aspect of your business unit’s profitability.

What strategies have you developed and put into place to increase the profits in your business? Are you or your team clear on what these are and how to implement them? Whilst you may be told by your manager to focus on driving revenue, this is likely to be aimed at then turning those additional sales into extra profit. So, if profit is the end game …

How do we increase profits?

It may seem very simplistic but there are only three ways to increase your profit:

- Increase prices

- Reduce costs and/or

- Increase sales volume?

It’s fundamental that you understand how they can make an impact on any or all of these strategies.

Often a business may focus on one in preference to others and that might be quite appropriate as I explain below.

Firstly let’s have a look at each of these in turn:

Increasing Prices

By raising prices or giving discounts, the impact will go straight to your bottom line. Even in economically challenging times, it is still worth considering what could be done to increase prices and at the same time be cautious about offering discounts.

So a few actions that you could implement:

- Raising prices selectively. It does not have be all or nothing. If you have a range of products, then consider raising prices of your less popular items rather than your best sellers – it is likely your best sellers need to be very competitively priced to attract customers but you could perhaps experiment with raising the price of your slower moving items.

- Volume discounts. Encourage your best customers to spend more on your products or services by offering a time restricted volume discount (e.g. 5% discount on sales in excess of $500k up to 31.12.2019. This way, you can keep your standard prices, but you will be offering an incentive for a bigger spend from your customers.) Now note I am suggesting that the discount is only on the amount above a set threshold. I have certainly had prospective clients who have asked me to discount from day 1, dangling a carrot of large volumes of work. If you structure your pricing this way, they will get this discount but only if they follow through on their promise of volume. If you were to discount your standard price/rate from day 1 it can be very difficult to subsequently raise it.

- Reduce or discontinue ‘giveaways’. These extras could be costing you more than you think without bringing you in more sales. If they aren’t helping with your sales, then stop them altogether. Now I know we want to surprise and delight customers but be aware of what you are giving away – I think you maybe unpleasantly surprised by the actual cost. With this one, it could be your well-meaning team members who are doing this.

- Early payment discounts. Unless you are going to make big savings in terms of bank interest, then there might not be a good reason to offer these types of discounts. Do your sums and ensure you are not giving away more than you gain. With low interest rates at the moment is this really worth it or is your bank balance in a bad way? ( When I say do your sums, work out what interest you will save by receiving the money x days earlier than you would if you did not offer the discount versus the cost of the discount E.g. Say you offered 1% discount for payment 15 days earlier than your normal 30 day terms. If your bank interest rate were 6.5% and the customer owed you $200k. By receiving the $198k 15 days earlier you would save $529, however you will have given away $2,000 in discount!)

Related to this point, is to always remember to invoice as quickly as possible if you want to increase your chances of being paid. Not only is this likely to lead to less disputed invoices but you get paid quicker. This becomes even more critical if you have a large key client and they have a monthly payment cycle. If this is the case, do you know when their monthly cut off is for their Accounts Payable payment? If it is the 25th of the month, then by waiting to invoice till the end of the month, you will miss this cut off and probably lose almost 30 days in getting paid.

Reducing Costs

Before you start considering how to cut salary costs, be sure to analyse other areas where you could make savings. Consider these:

- Buy better. Check whether you are getting a good deal from your ‘preferred supplier’. It might be that you could make cost savings from say, stationery, travel, communications or fleet management. If you have a small business, can you pool your purchasing dollars with others to give you more negotiating power and all save?

Related to this is the opposite of the point re sales invoicing. Try to wait to the start of a new month before you place your purchase order. If your supplier have EOM terms than you may have gained an extra month’s time to pay.

- Less waste. Reduce wastage and costs, whether this is by having printing policies around the use of colour or duplex printing or electric lights on timers, look at where you can cut back and help the environment at the same time.(However I have to tell you 3 sided printing does not work – I have mistakenly tried it!!) Have a brainstorming session with your team – they might surprise you with some great ideas.

- Zero based budgeting. Work on your budget backwards. Focus on the deliverables of the business and work out what you need to be able to deliver these outputs and outcomes. Whilst this approach takes longer, it is a really great way to challenge each of your costs rather than using historical budgeting – with “It cost $x last year so it will cost $x+ next year” Click on the link if you need an explanation of zero based budgeting.

Increase sales volume

Every business needs sales volume but can I suggest that revenue for revenue’s sake is not necessarily the way to go.

- Target your customers. Instead of chasing every prospect, look at the demographics of your best customers.

-

- What is it that is common about them?

- How can you attract more of these types of customers?

- Do you know which customers are your most and least profitable?

Unfortunately it is often true that the customers who give us most grief and the most unprofitable when we take into account the cost to serve them. Think of all the time you take trying to service these customers, how they may insist on special discounts and then take ages to pay you. Can I respectfully suggest that you do not want these customers? One of my friends “fires” these customers – maybe a bit drastic but what is the point of chasing customers where the deal is actually unprofitable. Can you raise prices to compensate for the service they demand, find a win/win or send them to one of your competitors?

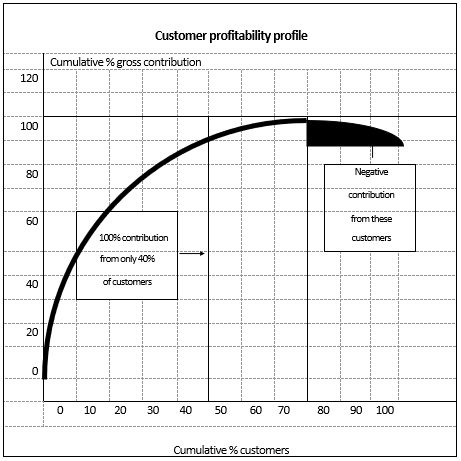

The chart below is similar to what one of my clients referred to as the ‘whale diagram’. It is based on an old study which looked at the profitability of one company’s customer base after taking into account all the costs of servicing that customers from margins on the products they purchase through to the time they take to pay. (This sort of analysis is commonly done using Activity Based Costing.) To explain the chart – if every customer were equally profitable, then the line shown would have been a straight diagonal line from bottom left to top right. Instead, as you will note, in this case 40% of the customers are providing the total profit, with some 20% of customers actually costing more to serve than the value of their sales.

Whilst this analysis may not exactly apply to your customer base, it is worth asking whether all your customers are equally profitable.

- Add on sales. What else could you offer? Can you offer additional items or services to help your customers or clients? Maybe this is another opportunity for a brainstorming session with your team?

- Have a minimum for EFTPOS. Many businesses set a minimum amount for using credit cards or EFTPOS. You may have noticed this practice in some cafés or shops. Has this happened to you? If you have not got the cash, you probably buy something else! So potentially it can lead to add on sales and will minimise your merchant fees on low value transactions.

I mentioned earlier that different strategies are more appropriate to some business and some to others.

Please free to add your tips and comments on the above. If you like this article, please feel free to share.

To find out more about how Financial Training Australia can help your non-financial staff then please visit our website or email me at cherry@financialtrainingaustralia.com. We offer a range of services from public courses to totally customised programs and one on one coaching.